Long story short: Planning to buy a two-wheeler in India? Learn about the motorcycle/two-wheeler road tax online/ offline payment details with our comprehensive guide. Stay ahead of the game!

Owning a two-wheeler in India is convenient, affordable, and gives you freedom. However, it’s also important to understand road tax. In fact, knowing how it works, the rates in your state, and how to pay helps you stay legal, plan your budget, and avoid issues.

To help you navigate this topic, this guide breaks down two-wheeler road tax in India in simple terms. Whether you’re buying your first bike or upgrading, you’ll find clear explanations, practical tips, and up-to-date information. Furthermore, we cover state rules, payment steps, and common questions all in one place.

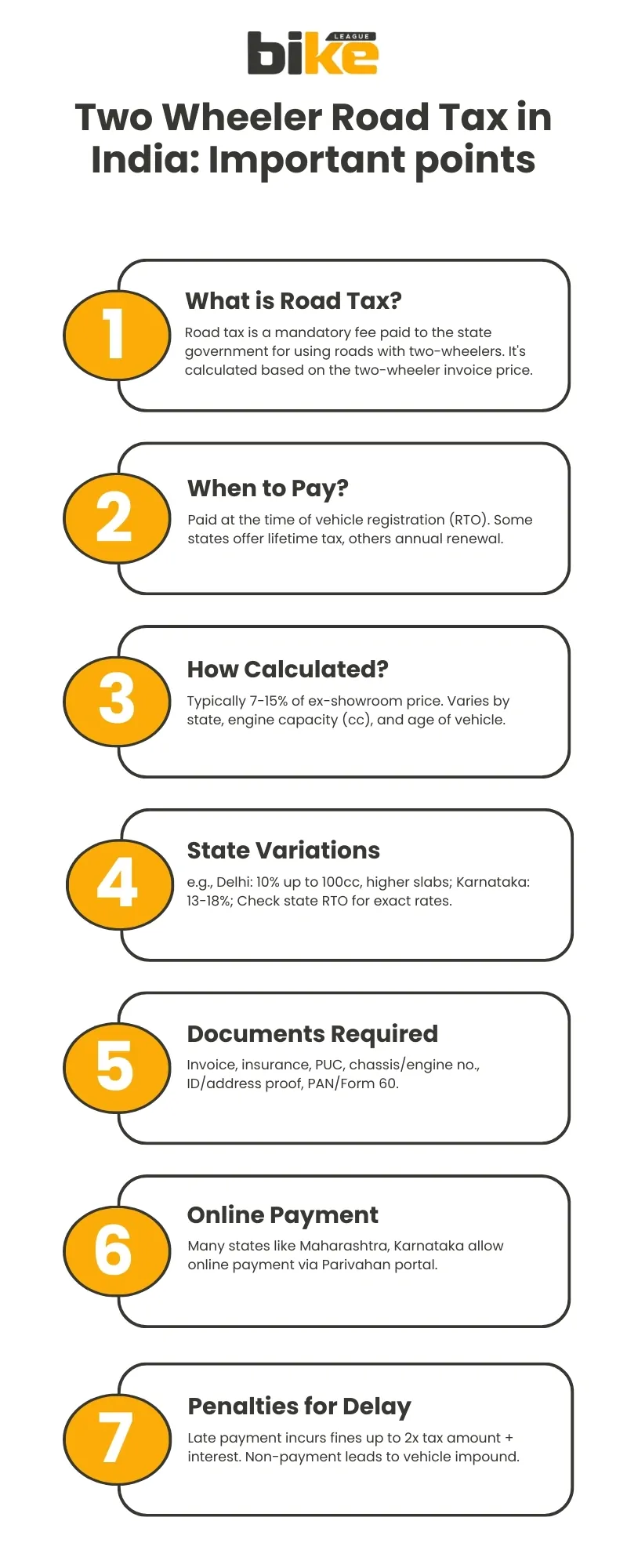

Key Takeaways

- Road tax is mandatory for all two-wheelers in India and is levied by both state and central governments, with rates and rules varying by state.

- The main factors affecting two-wheeler road tax include engine capacity, vehicle age, weight, value, and state-specific regulations, making it crucial to verify local requirements before purchasing or relocating.

- Road tax payments can be made both online (via platforms like Parivahan and VAHAN) and offline at the Regional Transport Office, with digital methods offering greater convenience and transparency.

- Timely payment of road tax ensures legal compliance, avoids penalties, and contributes to the maintenance and development of road infrastructure and public safety amenities.

- Common misconceptions about road tax include the belief that it is uniform across states, only paid offline, or identical to GST. Buyers should stay informed and regularly check official sources for accurate information.

What is Road Tax?

Road tax, or Motor Vehicle Tax, is a required fee charged by state and central governments on all private and commercial vehicles. Specifically, this tax mainly funds basic infrastructure and helps maintain road networks across the country.

Why the Government Imposes Motorcycle Road Tax

1. Maintenance and Development of Road Infrastructure

Road tax on motorcycles and other vehicles is mainly used to pay for maintaining and improving India’s roads. In other words, this money is needed to repair, expand, and upgrade roads so they stay safe and usable for everyone.

2. Provision of Basic Amenities and Safety Measures

Road tax money pays for things like street lights, road signs, and safety features that help keep everyone safe and make travel easier. It also helps fund emergency first-aid services for accidents, making roads safer.

3. Uniformity and Compliance

The road tax system aims to make vehicle taxes more consistent across states. Nevertheless, each state still has its own rates and rules, but the goal is to make things simpler and help everyone follow the law. This is especially important if you move to a new state, since you’ll need to follow local tax rules.

Pros of Motorcycle Road Tax

1. Improved Road Quality and Safety

One big benefit of road tax is better road quality and safety. For instance, the money collected helps fix and improve roads, which lowers the risk of accidents and damage to vehicles. Additionally, good lighting and clear signs also make driving safer.

2. Economic Growth and Development

Spending road tax money on better roads helps the economy grow. In turn, good roads make it easier to move goods and people, which boosts trade and business. Ultimately, this helps the country develop.

3. Convenience for Vehicle Owners

Online platforms like the Parivahan portal make it easier for vehicle owners to pay road tax. As a result, this saves time, cuts down on paperwork, and helps you avoid late fees.

Cons of Motorcycle Road Tax

1. Financial Burden on Vehicle Owners

One drawback of road tax is that it can be expensive for vehicle owners. For example, the cost can be high, especially if you’re buying a new vehicle or moving to a different state. Consequently, this can make owning a vehicle harder for some people.

2. Variability in Tax Rates

Different road tax rates in each state can be confusing. Moreover, each state has its own way of calculating the tax, so the same vehicle might cost more or less depending on where you live. This is especially tricky for people who move often.

3. Compliance Challenges

All the different road tax rules can make it hard for vehicle owners to follow the law. This confusion sometimes means people don’t pay the tax, so the government loses money. A simpler, more uniform system would help everyone follow the rules.

Key Factors Influencing Two-wheeler Road Tax Calculation

1. Engine Capacity

The engine size of your two-wheeler, measured in cubic centimetres (cc), is a key factor in road tax. States have different tax rates based on engine size. For example, in Rajasthan, the rates are 8% for engines up to 200cc, 13% for 200cc to 500cc, and 15% for engines above 500cc.

Similarly, in West Bengal, the tax rates are Rs. 1,560 for engines up to 80cc, Rs. 3,125 for engines between 80cc and 170cc, Rs. 4,685 for engines between 170cc and 250cc, and Rs. 6,250 for engines above 250cc.

2. Age of the Vehicle

The age of your vehicle also affects road tax. Newer vehicles usually have higher taxes than older ones. As vehicles age and lose value, the tax amount decreases.

3. Vehicle Weight

The weight of your vehicle can also affect road tax, especially in states like Uttar Pradesh, where the tax is based on the vehicle’s weight or value.

4. Vehicle Value

Another important factor is the vehicle’s value when you register it. For example, in Uttar Pradesh, the tax is 2% for vehicles under Rs. 0.20 lakh, 4% for Rs. 0.20–0.60 lakh, 6% for Rs. 0.60–2.00 lakh, and 8% for vehicles over Rs. 2.00 lakh.

5. State-Specific Regulations

Every state in India has its own rules and road tax rates. Make sure to check the rates for your state. For example, Maharashtra has different tax rates for motorcycles based on engine size: 10% for engines below 99cc, 11% for 99cc to 299cc, and 12% for engines above 299cc.

How to Calculate Two Wheeler Road Tax

1. Determine the Engine Capacity

Identify your two-wheeler’s engine capacity. This information is usually available in the vehicle’s registration certificate (RC) or owner’s manual.

2. Check the Vehicle’s Age

Determine your vehicle’s age from its first registration date. This will help you understand any depreciation-related tax benefits.

3. Identify the Vehicle’s Weight and Value

Check the unladen weight and the current market value of your two-wheeler. This information can be found in the vehicle’s documentation or through a professional valuation.

4. Refer to State-Specific Tax Rates

Visit the official website of your state’s transport department or the Parivahan portal to find the tax rates applicable to your vehicle based on its engine capacity, age, weight, and value.

5. Calculate the Tax

Applying the relevant tax rates to calculate the road tax using the information gathered. For example, if you own a two-wheeler in Rajasthan with an engine capacity of 250cc, you would apply a tax rate of 13% on the vehicle’s value.

How to check Two Wheeler Road Tax in India?

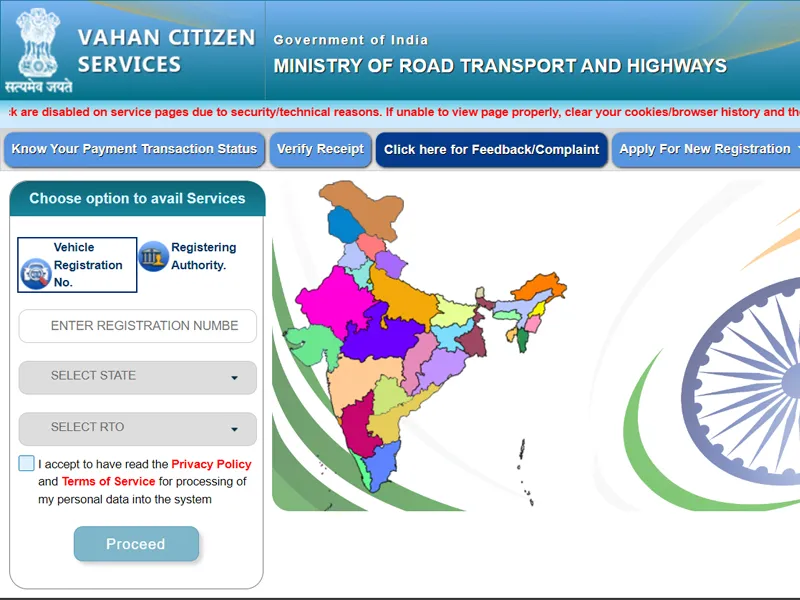

1. Visit the VAHAN Portal

The VAHAN portal is the official website for vehicle-related services in India. To check your road tax status, visit the VAHAN portal at https://vahan.parivahan.gov.in/vahanservice/vahan/.

2. Navigate to the Status Section

Once on the VAHAN portal, click the “Status” tab and select “Check Pending Transaction”. This section lets you check any pending transactions, including road tax payments.

3. Enter Vehicle Details

You must enter the last five digits of your vehicle’s registration and chassis numbers. Alternatively, you can use the transaction number if it is available.

4. View Details

After entering the required details, click on the “Show Details” button to view the status of your road tax. This will display any pending transactions or confirm that your road tax is up to date.

5. Clear Pending Transactions

If there are any pending transactions, you can click the transaction number to clear them.

How to make Motorcycle Road Tax payment online in India?

1. Visit the Parivahan Sewa Portal

To begin the process, visit the official Parivahan Sewa portal maintained by the Ministry of Road Transport & Highways, Government of India.

2. Enter the Vehicle Registration Number

Enter your vehicle registration number in the provided field on the homepage and click “Proceed”.

3. Select Online Services

Navigate to the “Online Services” section and select “Vehicle Related Services”.

4. Choose Your State and RTO

Select your state and the corresponding Regional Transport Office (RTO) from the drop-down menu.

5. Enter Vehicle Details

You will be prompted to enter additional details, such as the last 5 digits of your chassis number. Click on “Validate Regn_no/Chasi_no” to proceed.

6. Generate and Enter OTP

Click “Generate OTP” to receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP and submit.

7. Update Insurance Details

Ensure your vehicle’s insurance details are up to date. You may be required to update these details before proceeding.

8. Review Fee Panel

Review the fee panel that displays the applicable road tax amount. Confirm the details and proceed to payment.

9. Make the Payment

Choose your preferred payment method (credit card, debit card, or internet banking) and complete the payment.

10. Payment Receipt

After a successful online road tax payment, a receipt will be generated. You can download this receipt for your records. The application will then be moved to the RTO for further processing.

How to Download Two-Wheeler Road Tax Receipt in mParivahan and DigiLocker?

Downloading Vehicle Tax Receipt via mParivahan

mParivahan is a mobile application developed by the Ministry of Road Transport and Highways (MoRTH) that provides citizens with easy access to vehicle-related documents and services.

Steps to Download Motorcycle Road Tax Receipt in mParivahan

Step 1: Download the mParivahan app:

Visit the Google Play Store or Apple App Store and download the mParivahan app.

Step 2: Sign Up and Verify:

Open the app and sign up using your mobile number. Complete the verification process using the OTP sent to your registered mobile number.

Step 3: Complete Your Profile:

Fill in your details to complete your profile setup.

Step 4: Access Vehicle Documents:

Navigate to the menu and select the option to access your vehicle documents. You can search for your Registration Certificate (RC) using your RC number.

Step 5: Download the Receipt:

Once your RC is located, you can download the vehicle tax receipt directly from the app.

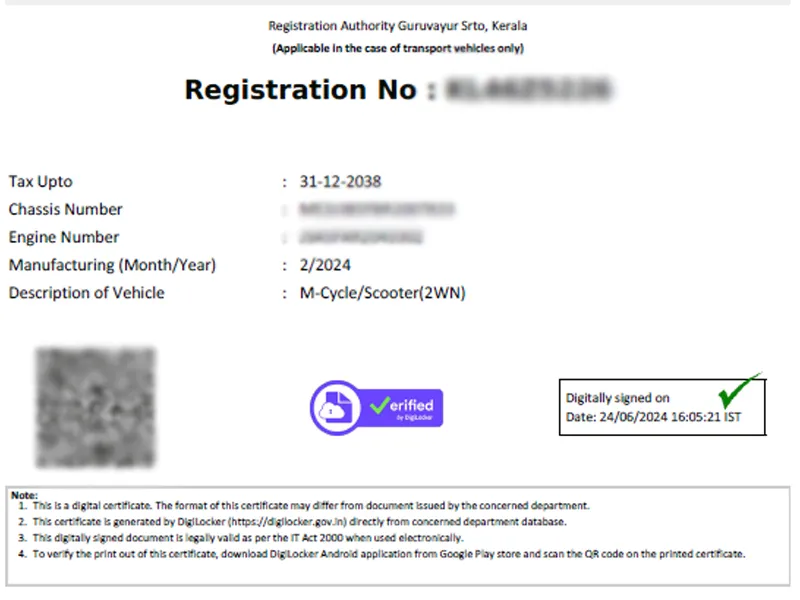

Downloading Vehicle Tax Receipt via DigiLocker

DigiLocker is a digital platform provided by the Government of India for securely storing and accessing important documents.

Steps to Download Vehicle Tax Receipt in DigiLocker

Step 1: Visit the DigiLocker Website or App:

Go to the DigiLocker website (https://digitallocker.gov.in/) or download the DigiLocker app from the Google Play Store or Apple App Store.

Step 2: Create an Account:

If you do not have an account, create one using your Aadhaar card. Sign up using your mobile number and complete the OTP verification.

Step 3: Link Aadhaar and Login:

Link your account with your Aadhaar number and set up a username and password. Log in using your credentials.

Step 4: Search for Vehicle Documents:

Go to the ‘Issued Documents’ tab on the home page and select ‘Get More Issued Documents’. Choose ‘Ministry of Road and Transport’ and click the ‘Registration of Vehicles’ tab.

Step 5: Enter Vehicle Details:

Enter your vehicle’s registration and chassis numbers, then submit the details.

Step 6: Download the Receipt:

Click the ‘Get Document’ option to retrieve your vehicle tax receipt. You can then download it from the ‘Issued Documents’ tab in PDF format.

Misconceptions about two-wheeler Road Tax in India

1. Do two-wheelers have to pay toll tax on national highways?

No, two-wheelers are fully exempt from tolls on national highways under the National Highways Fee Rules, 2008, due to low road damage and their role in mass mobility. Viral claims of upcoming tolls or FASTag mandates (e.g., from July 2025) are fake news, as NHAI and Minister Nitin Gadkari have clarified multiple times.

2: Is road tax a one-time payment forever?

Not always—it depends on the state; many charge a lifetime tax (10-15 years) upfront, but others, like Delhi or UP, require annual/biennial renewals based on age and engine size. Late renewal incurs fines up to 1.5x the tax amount.

3: Is road tax the same across all Indian states?

No, rates vary widely: e.g., 4-12.5% in Delhi (engine-based), 10-21% in Kerala (price-based), with EVs often at 0-2%. Check your state’s RTO or Parivahan portal for slabs tied to ex-showroom price and CC.

4: Is road tax already included and hidden in the on-road price?

It’s explicitly listed on the invoice as part of the on-road price (alongside insurance/registration), but dealers may inflate it using CKD/CBU norms—always verify the breakup to avoid scams. GST (18-40% on bikes) is separate from the state road tax.

5: Do electric two-wheelers pay the same road tax as petrol bikes?

Often, lower or zero—states like Delhi, Maharashtra offer full exemptions or rebates to promote EVs, unlike ICE bikes at 8-18%. Confirm via state notifications, as 2026 incentives continue.

6: Can you skip road tax if you don’t ride on highways?

No, road tax grants permission to use all public roads in the state, not just highways; it’s mandatory for registration regardless of usage. Non-payment blocks RC issuance and invites penalties even for local rides.

7: Is road tax based only on engine size or CC?

Not solely—most states use ex-showroom price as the primary factor (e.g., 10-12% slabs), with CC/weight as the secondary factor; some, like UP, are purely cost-based. High-end >350cc bikes may fall into higher brackets, plus hypothecation fees.

8: Does renewing insurance cover road tax automatically?

No, insurance and road tax are separate—renewing the policy doesn’t pay tax dues; check via Parivahan for validity to avoid fines during checks. Some states link them for convenience but not as substitutes.

9: Is there a refund if you move to another state?

Partial refunds are possible for unused lifetime tax periods via the old RTO NOC, but the new state charges full, fresh tax on re-registration. Process takes 30-60 days; EVs may retain incentives across state lines.

10: Are luxury or imported bikes taxed higher permanently?

Yes, premium bikes (>₹2 lakh or >500cc) often fall in top slabs (15-21%) with additional green cess in states like Karnataka/Maharashtra. No ongoing hikes post-registration unless renewed.

Frequently Asked Questions about two-wheeler Road Tax in India

1. What is the road tax for two-wheelers in India?

Road tax is a mandatory fee imposed by state and central governments for using public roads. It applies to all two-wheelers and funds infrastructure maintenance.

2. How is the road tax amount calculated for two-wheelers?

The amount depends on factors like engine capacity, vehicle age, weight, value, and the state’s specific regulations.

3. Is road tax the same in every Indian state?

No, road tax rates and rules vary significantly between states, so it’s important to check local regulations before purchase or transfer.

4. Can I pay two-wheeler road tax online?

Yes, you can pay through official platforms such as Parivahan and VAHAN, as well as some state-specific transport portals.

5. What documents are required for paying road tax?

Typically, you need the vehicle’s registration certificate (RC), invoice, identity proof, and address proof.

6. What happens if I don’t pay my two-wheeler road tax on time?

Late payment can result in fines, legal action, and trouble renewing your vehicle registration.

7. Do I need to pay road tax again if I move my two-wheeler to another state?

Yes, you’ll usually have to pay road tax in the new state and may be eligible for a refund from the previous state, depending on the rules.

8. Is road tax a one-time payment or recurring?

It can be either, depending on the state. Some states allow a one-time lifetime tax, while others require annual or periodic payments.

9. Is road tax the same as GST?

No, road tax is separate from Goods and Services Tax (GST). Road tax is for vehicle use on public roads, while GST is a consumption tax on goods and services.

10. Where can I find the latest information on two-wheeler road tax?

Always check official government portals or your local Regional Transport Office (RTO) for current rates and rules.

Important official links for Two Wheeler online Road Tax payment in India

Other related articles from Bikeleague India

- State wise Road Tax : Navigating India’s Two Wheeler Tax

- Two wheeler insurance in India – How to buy and select

- Bike ownership transfer in India – step by step guide

- Electric scooter subsidy in India : A comprehensive guide

- Bike On-road price calculator

Conclusion

Every two-wheeler owner in India should understand road tax. Knowing your state’s rules and how to pay helps you stay legal and makes bike ownership simpler. Paying on time also supports better roads and infrastructure.

Road tax rules keep changing, but digital services make it easier to stay updated. Use this guide to manage your road tax, whether you’re buying a new bike, moving, or keeping your documents up to date. Staying informed helps you make better decisions.

If you have questions about motorcycle road tax in India, you can email us at bikeleague2017@gmail.com or leave a comment below. We’re here to help. You can also reach out to Bikeleague India on social media.