Long story short: Planning to buy a two-wheeler in India in 2025? Learn about the motorcycle/two-wheeler road tax online/ offline payment details with our comprehensive guide. Stay ahead of the game!

Key Takeaways

- A mandatory tax levied by state and central governments to fund road infrastructure, safety measures, and compliance regulations.

- They Enhance road quality and safety, Contribute to economic growth by improving transport infrastructure and offer digital payment convenience via platforms like Parivahan.

- Engine capacity, Vehicle age, Vehicle weight and value, State-Specific Rules are the Factors affecting

Road Tax Calculation - To check Road Tax Status, visit the VAHAN portal and enter vehicle details to check pending tax payments.

- Done via the Parivahan Sewa portal by entering vehicle registration details, verifying with OTP, and making payment.

What is Road Tax?

Road tax, also known as Motor Vehicle Tax, is a compulsory tax levied by the state and central governments on all types of private and commercial vehicles. The primary purpose of this tax is to provide basic infrastructural facilities and maintain road networks across the country.

Why the Government Imposes Motorcycle Road Tax

1. Maintenance and Development of Road Infrastructure

Road tax on motorcycles and vehicles is primarily collected to finance the maintenance and development of India’s vast road network. This funding is essential for repairing, expanding, and upgrading roadways to keep them safe and functional for all users.

2. Provision of Basic Amenities and Safety Measures

Road tax revenue is used to fund essential amenities like street lights, road signs, and safety measures, which are vital for the safety and convenience of road users. The funds also support emergency first aid services for accidents, improving road safety.

3. Uniformity and Compliance

The road tax system seeks to standardize vehicle taxation across states. While each state has its own rates and regulations, the main goal is simplifying the process and ensuring compliance. This is especially crucial for people moving to new states, as they must follow local road tax laws.

Pros of Motorcycle Road Tax

1. Improved Road Quality and Safety

One of the significant benefits of road tax is the improvement in road quality and safety. The funds collected are used to maintain and upgrade roads, which reduces the likelihood of accidents and vehicle damage due to poor road conditions. Enhanced road safety measures, such as better lighting and clear signage, also contribute to a safer driving environment.

2. Economic Growth and Development

Investing in road infrastructure through road tax revenue promotes economic growth. Good roads facilitate smoother transportation of goods and people, boosting trade and commerce. This, in turn, contributes to the country’s overall economic development.

3. Convenience for Vehicle Owners

The introduction of digital platforms like the Parivahan web portal has made it easier for vehicle owners to pay their road taxes online. This convenience reduces the hassle of offline payments and ensures timely compliance, thereby avoiding penalties.

Cons of Motorcycle Road Tax

1. Financial Burden on Vehicle Owners

One of the primary disadvantages of road tax is the financial burden it places on vehicle owners. The tax amount can be significant, especially for individuals purchasing new vehicles or relocating to a different state. This can be a deterrent for potential buyers and may impact the affordability of vehicle ownership.

2. Variability in Tax Rates

The variability in road tax rates across different states can lead to discrepancies and confusion among vehicle owners. Each state has its own parameters for calculating road tax, resulting in varying tax amounts for the exact vehicle in different states. This lack of uniformity can be challenging for individuals who frequently move between states.

3. Compliance Challenges

The diversity of rules and regulations regarding road tax can incentivize non-compliance. Vehicle owners may need help navigating the different tax laws, leading to potential evasion and loss of revenue for the government. The current system’s complexity underscores the need for a more streamlined and uniform tax structure.

Key Factors Influencing Two wheeler Road Tax Calculation

1. Engine Capacity

The engine capacity of your two-wheeler, measured in cubic centimetres (cc), is a primary determinant of the road tax. Different states have varying tax rates based on engine capacity. For instance, in Rajasthan, the road tax rates are 8% for engines up to 200cc, 13% for engines between 200cc and 500cc, and 15% for engines above 500cc.

Similarly, in West Bengal, the tax rates are Rs. 1,560 for engines up to 80cc, Rs. 3,125 for engines between 80cc and 170cc, Rs. 4,685 for engines between 170cc and 250cc, and Rs. 6,250 for engines above 250cc.

2. Age of the Vehicle

The age of the vehicle also affects the road tax. Newer vehicles generally attract higher taxes compared to older ones. However, the value of older vehicles depreciates over time, leading to a lower tax amount.

3. Vehicle Weight

The vehicle’s weight can influence the road tax, especially in states like Uttar Pradesh, where the tax for two-wheelers is based on the unladen weight or value of the vehicle.

4. Vehicle Value

Another crucial factor is the vehicle’s value at the time of registration. For example, in Uttar Pradesh, the tax rates are 2% for vehicles valued below Rs. 0.20 lakh, 4% for vehicles valued between Rs. 0.20 lakh and Rs. 0.60 lakh, 6% for vehicles valued between Rs. 0.60 lakh and Rs. 2.00 lakh, and 8% for vehicles valued above Rs. 2.00 lakh.

5. State-Specific Regulations

Each state in India has its own set of rules and road tax rates. It is essential to check the specific regulations and rates applicable in your state. For instance, Maharashtra has different tax slabs for motorcycles based on engine capacity, with rates of 10% for engines below 99cc, 11% for engines between 99cc and 299cc, and 12% for engines above 299cc.

How to Calculate Two Wheeler Road Tax

1. Determine the Engine Capacity

Identify your two-wheeler’s engine capacity. This information is usually available in the vehicle’s registration certificate (RC) or owner’s manual.

2. Check the Vehicle’s Age

Determine your vehicle’s age from the date of its first registration. This will help you understand any depreciation-related tax benefits.

3. Identify the Vehicle’s Weight and Value

Check the unladen weight and the current market value of your two-wheeler. This information can be found in the vehicle’s documentation or through a professional valuation.

4. Refer to State-Specific Tax Rates

Visit the official website of your state’s transport department or the Parivahan portal to find the tax rates applicable to your vehicle based on its engine capacity, age, weight, and value.

5. Calculate the Tax

Applying the relevant tax rates to calculate the road tax using the information gathered. For example, if you own a two-wheeler in Rajasthan with an engine capacity 250cc, you would apply a tax rate of 13% on the vehicle’s value.

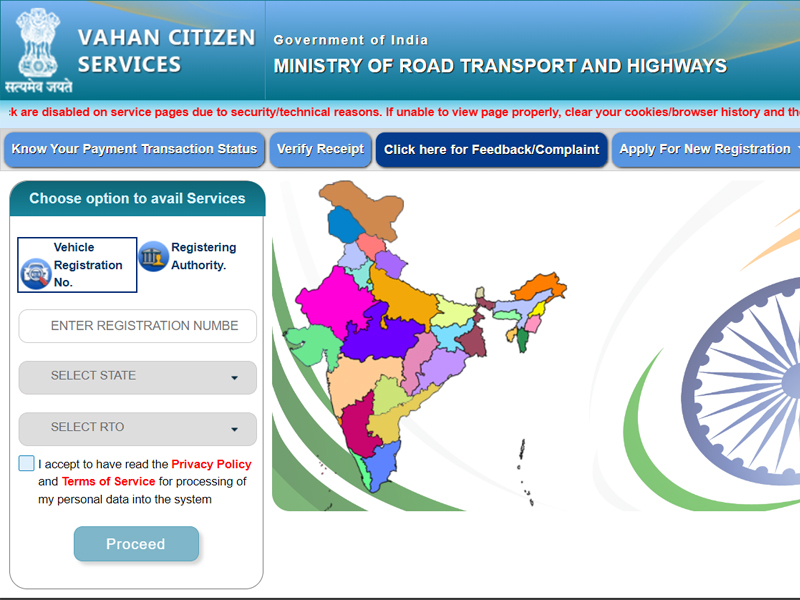

How to check Two Wheeler Road Tax in India

1. Visit the VAHAN Portal

The VAHAN portal is the official website for vehicle-related services in India. To check your road tax status, visit the VAHAN portal at https://vahan.parivahan.gov.in/vahanservice/vahan/.

2. Navigate to the Status Section

Once on the VAHAN portal, click the “Status” tab and select “Check Pending Transaction”. This section lets you check any pending transactions, including road tax payments.

3. Enter Vehicle Details

You must enter the last five digits of your vehicle’s registration and chassis numbers. Alternatively, you can use the transaction number if it is available.

4. View Details

After entering the required details, click on the “Show Details” button to view the status of your road tax. This will display any pending transactions or confirm that your road tax is up-to-date.

5. Clear Pending Transactions

If there are any pending transactions, you can click on the transaction number to proceed with clearing them.

How to make Motorcycle Road Tax payment online in India

1. Visit the Parivahan Sewa Portal

To begin the process, visit the official Parivahan Sewa portal maintained by the Ministry of Road Transport & Highways, Government of India.

2. Enter the Vehicle Registration Number

Enter your vehicle registration number in the provided field on the homepage and click “Proceed”.

3. Select Online Services

Navigate to the “Online Services” section and select “Vehicle Related Services”.

4. Choose Your State and RTO

Select your state and the corresponding Regional Transport Office (RTO) from the drop-down menu.

5. Enter Vehicle Details

You will be prompted to enter additional details, such as the last 5 digits of your chassis number. Click on “Validate Regn_no/Chasi_no” to proceed.

6. Generate and Enter OTP

Click “Generate OTP” to receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP and submit.

7. Update Insurance Details

Ensure that your vehicle’s insurance details are up-to-date. You may be required to update these details before proceeding.

8. Review Fee Panel

Review the fee panel that displays the applicable road tax amount. Confirm the details and proceed to payment.

9. Make the Payment

Choose your preferred payment method (credit card, debit card, or internet banking) and complete the payment.

10. Payment Receipt

After a successful road tax payment online, a receipt will be generated. You can download this receipt for your records. The application will then be moved to the RTO for further processing.

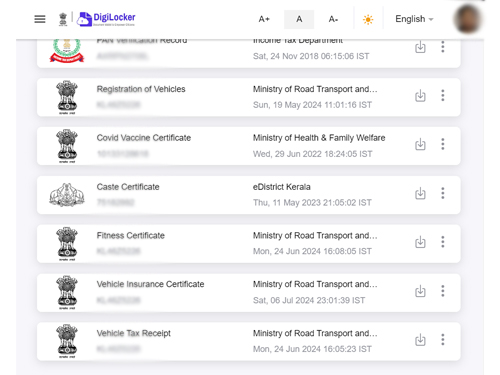

How to Download two wheeler Road Tax Receipt in mParivahan and DigiLocker?

Downloading Vehicle Tax Receipt via mParivahan

mParivahan is a mobile application developed by the Ministry of Road Transport and Highways (MoRTH) to give citizens easy access to vehicle-related documents and services.

Steps to Download Motorcycle Road Tax Tax Receipt in mParivahan

Step 1: Download the mParivahan app:

Visit the Google Play Store or Apple App Store and download the mParivahan app.

Step 2: Sign Up and Verify:

Open the app and sign up using your mobile number. Complete the verification process using the OTP sent to your registered mobile number.

Step 3: Complete Your Profile:

Fill in your details to complete your profile setup.

Step 4: Access Vehicle Documents:

Navigate to the menu and select the option to access your vehicle documents. You can search for your Registration Certificate (RC) using your RC number.

Step 5: Download the Receipt:

Once your RC is located, you can download the vehicle tax receipt directly from the app.

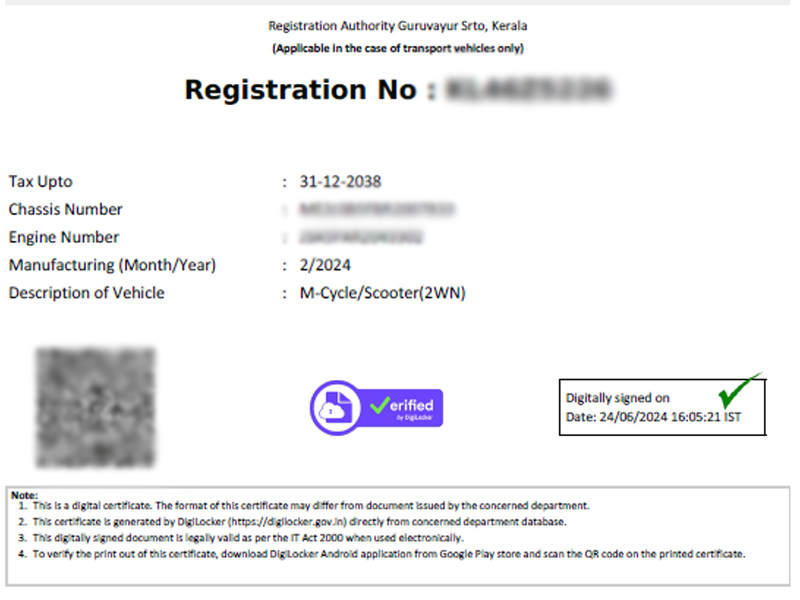

Downloading Vehicle Tax Receipt via DigiLocker

DigiLocker is a digital platform the Government of India provides for securely storing and accessing important documents.

Steps to Download Vehicle Tax Receipt in DigiLocker

Step 1: Visit the DigiLocker Website or App:

Go to the DigiLocker website (https://digitallocker.gov.in/) or download the DigiLocker app from the Google Play Store or Apple App Store.

Step 2: Create an Account:

If you do not have an account, create one using your Aadhaar card. Sign up using your mobile number and complete the OTP verification.

Step 3: Link Aadhaar and Login:

Link your account with your Aadhaar number and set up a username and password. Log in using your credentials.

Step 4: Search for Vehicle Documents:

Go to the ‘Issued Documents’ tab on the home page and select ‘Get More Issued Documents’. Choose ‘Ministry of Road and Transport’ and click the ‘Registration of Vehicles’ tab.

Step 5: Enter Vehicle Details:

Enter your vehicle’s registration and chassis numbers, then submit the details.

Step 6: Download the Receipt:

Click the ‘Get Document’ option to retrieve your vehicle tax receipt. You can then download it from the ‘Issued Documents’ tab in PDF format.

Misconceptions about two-wheeler Road Tax in India

Misconception 1: Road tax is the same for all two-wheelers in India

This is not true. Road tax for two-wheelers in India varies from state to state. It is calculated based on factors such as the vehicle’s cost price, engine capacity, age, and type of fuel it runs on.

Misconception 2: Road tax for electric two-wheelers is higher than for conventional two-wheelers

This is not necessarily true. Some states in India offer incentives and lower tax rates for electric vehicles, including two-wheelers, to promote their usage and reduce pollution. You must check with the local Regional Transport Office (RTO) or the state transport department for specific information on road tax for electric two-wheelers in your state.

Misconception 3: Road tax can only be paid in person at the RTO

This is not true. In many states, including Delhi and Maharashtra, you can pay road tax for two-wheelers online through the respective state transport department websites. However, online road tax payment availability may vary from state to state, so you should check your transport department’s official website for more information.

Misconception 4: Road tax is a one-time payment

This is only sometimes true. Depending on the state’s regulations, road tax can be paid annually or as a one-time payment. Different states have different methods of collecting road tax, and knowing your state’s specific rules and regulations is essential.

Misconception 5: GST and road tax are the same

This is not true. Goods and Services Tax (GST) and road tax are separate taxes in India. GST is a nationwide tax levied on goods and services, including two-wheelers. In contrast, road tax is a state-level tax imposed on vehicles to legally drive them on Indian roads. It is important to note that road tax rates and regulations may vary across states in India. You should check with the local RTO or the state transport department for the most accurate and up-to-date information regarding road tax for two-wheelers in your location.

Frequently Asked Questions about two wheeler Road Tax in India

1: How is tax payment calculated for bikes in India?

Road tax for two-wheelers in India is calculated based on various factors such as the vehicle’s cost price, engine capacity, age, and the state in which it is registered. Each state has its own tax structure and calculation method. For example, in Andhra Pradesh, the road tax for two-wheelers is based on the vehicle’s engine capacity, while in Maharashtra, it is determined by the cost of the vehicle and the type of fuel it runs on.

2: What is the process for motorcycle road tax payment in India?

To pay road tax for a two-wheeler in India, you need to visit the respective Regional Transport Office (RTO) under whose jurisdiction your vehicle falls. The RTO will provide the necessary information and guidance on calculating and paying your two-wheeler’s road tax.

3: Is road tax different for electric two-wheelers in India?

Yes, road tax for electric two-wheelers in India is often categorized separately. Some states offer incentives and lower tax rates for electric vehicles to promote their usage and reduce pollution. You should check with the local RTO or the state transport department for specific information on road tax for electric two-wheelers in your state.

4: How to pay road tax online for two-wheelers in India?

You can pay road tax for two-wheelers online in many states, including Delhi and Maharashtra. The respective state transport department websites provide online road tax payment options for road tax. However, online road tax payment availability may vary from state to state, so you should check your transport department’s official website for more information.

5: How does road tax contribute to the total cost of a two-wheeler in India?

Road tax contributes to the total cost of a two-wheeler in India. When purchasing a vehicle, the on-road price includes the base manufacturing price, registration charges, road tax, and insurance. The road tax is paid to the government to legally drive the vehicle on Indian roads. Considering the road tax and other costs when budgeting for a two-wheeler purchase is essential.

Please note that road tax rates and regulations may vary across states in India. You should always check with the local RTO or the state transport department for the most accurate and up-to-date information regarding road tax for two-wheelers in your location.

6: Is motorcycle road tax calculated on the ex-showroom price or on-road price of the two-wheeler in India?

The road tax for motorcycles in India is calculated based on the vehicle’s ex-showroom price. This tax is a one-time payment made during vehicle registration. It is typically a percentage of the ex-showroom price.

Important official links for Two Wheeler online Road Tax payment in India

Other related articles from Bikeleague India

- Unlocking the secrets: Factors that impact bike loan interest rate

- Which bike chassis is right for your riding style

- How to finance your dream bike with a motorcycle loan

- Exploring subsidies & incentives for electric scooters in India

- Simple Energy

Conclusion

Two-wheeler road tax is an essential component of vehicle ownership in India, ensuring the maintenance and development of road infrastructure. The rates vary significantly across states and depend on vehicle type, engine capacity, age, purpose of usage, mode of payment, etc. Understanding these variations helps motorcycle owners comply with legal requirements and avoid penalties.

If you have any other doubts or queries about the Motorcycle road tax in India, email us at bikeleague2017@gmail.com or share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.