Long story short: Here, we will discuss the tips or techniques to reduce your yearly bike insurance premium and save your money.

Bike insurance or motorcycle insurance is mandatory as mandated by the law in India. Every motorcycle or two-wheeler owner in India should buy or must have motorcycle insurance as per the Motor Vehicles Act 1988. To learn more about buying and selecting two-wheeler insurance, check out this article. Most bike owners have minimal knowledge about insurance and buy for the sake of it. Insurance companies in India are coming with several benefits and features that are very useful for owners. However, the reality is that many need to learn them and fully take the words from insurance or showroom agents.

Do you know that your motorcycle driving behaviour is considered part of the insurance premium? Yes, this fact is 100% correct. Other factors are also considered, and we will discuss them in-depth throughout this article. Also, several destructive tendencies and misconceptions among two-wheeler owners are discussed here. So, let’s start digging deep and get rid of your doubts and learn how to save money on the bike insurance premium policy

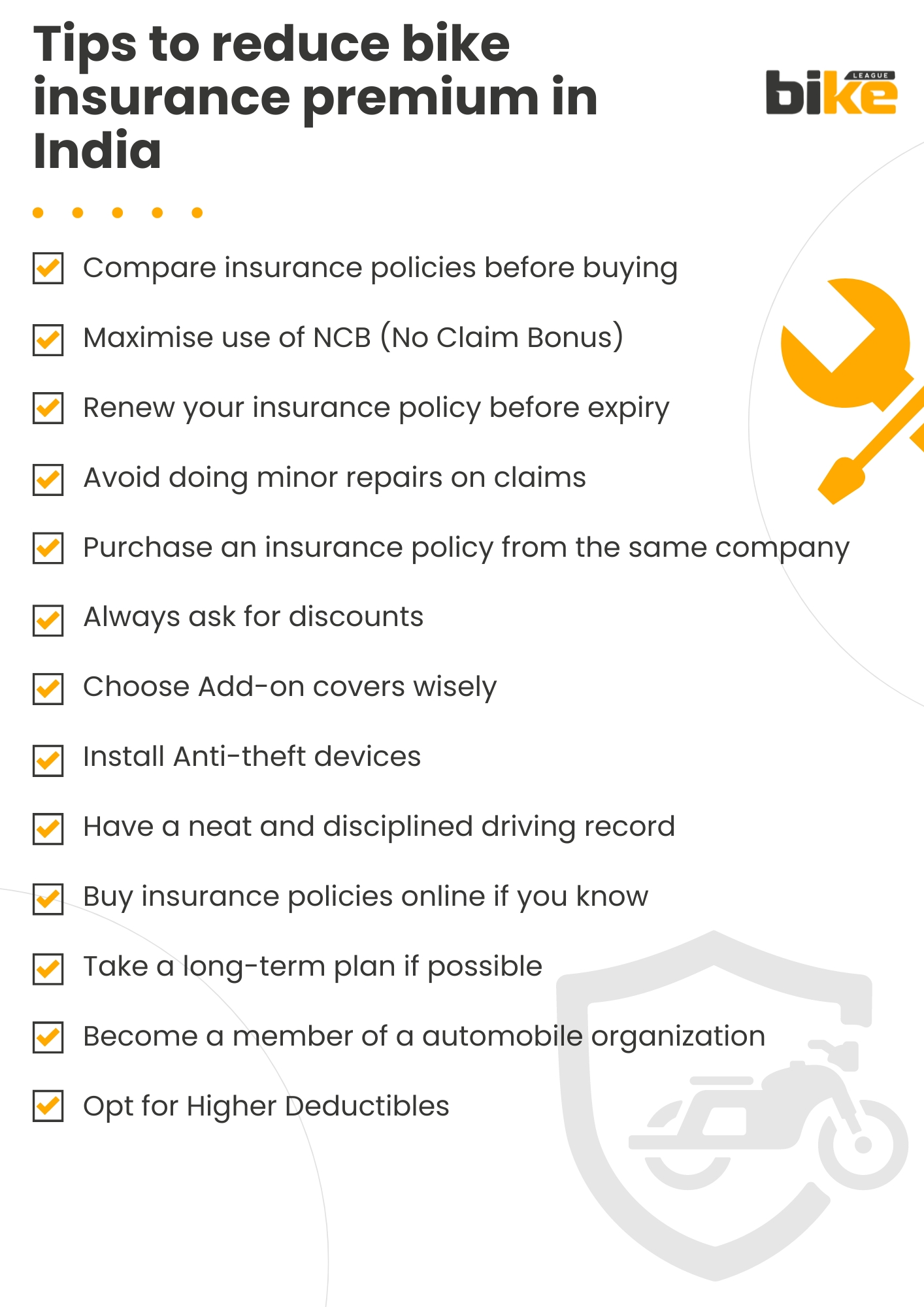

Tips to reduce bike insurance premium to save money in India

Tip 1:Compare insurance policies before buying a bike

Start by comparing different two-wheeler insurance policies available in the market. Online website comparison tools provide transparency in coverage options and pricing, enabling you to make well-informed decisions that can lead to significant savings.

Evaluating various policies based on your specific requirements ensures you get the best deal. Focus on more than just the insurance premium; check the features and renewal amount in the upcoming year. The first-year premium might be low to attract customers, but the renewal premium will be high, so take care of that.

Tip 2:Maximise use of NCB (No Claim Bonus)

The No Claim Bonus (NCB) is a powerful tool for reducing insurance costs. Suppose you have yet to make any claims during the policy period. In that case, you can accumulate NCB, which directly leads to lower premiums in subsequent years. Protecting this bonus should be a priority, and if you switch insurers, ensure your NCB is transferred.

Suppose your bike has had no claims for a year. In that case, the insurance company will reward you with NCB, which means a 20-50% deduction in the year premium, which benefits both the vehicle owner and the insurance company.

Tip 3:Renew your bike insurance policy before expiry

Renewing your policy before expiry helps avoid unnecessary paperwork, like taking photographs of the vehicle, other documentation, etc., and your NCB (No-Claim Bonus) benefits will not be lost.

4. Tip 4:Avoid doing minor repairs on claims

Most showrooms insist you claim for minor repairs and damages so that no amount is spent from your side. Cool thing, right? But you will have to pay a higher premium in the upcoming year. That amount might be negligible, but when you do repairs frequently in this manner, the premium will be very high.

Tip 5:Purchase an bike insurance policy from the same company

Renewing your motorcycle insurance with the same company for several years increases your chances of getting rewards, discounts or loyalty points for being a loyal customer for several years, which all companies love to have.

Tip 6:Always ask for discounts

Some motorcycle insurance companies might be hesitant to provide discounts, so it would be best to ask for them; there is no need to be ashamed. Some insurance personnel might not tell you anything about discounts because of inexperience or other company agendas.

Tip 7:Choose Add-on covers wisely

Most insurance companies offer several good add-on covers, but you must ensure they are worth it for your bike. Add-on covers will only increase your insurance rate and premium, never decrease it. Also, avoid getting lured by sales personnel’s words and think wisely before making a choice.

Tip 8:Install Anti-theft devices

Motorcycle insurance companies offer lower insurance premiums if you secure your two-wheeler with security devices such as anti-theft alarms. Ensure the anti-theft device you install is approved by the Automotive Research Association of India (ARAI) to avail of the discount on the bike insurance premium.

Tip 9:Have a neat and disciplined driving record

A clean driving record is crucial in reducing your insurance premium. Insurers favour drivers with fewer accidents and violations, as they pose a lower risk. Safe riding practices, such as adhering to traffic rules and avoiding risky manoeuvres, can significantly reduce the likelihood of accidents.

Tip 10:Buy bike insurance policies online if you know

Another effective way to save money is to purchase bike insurance online. It does not include an agent commission cost.But if you have little or no insurance basics, opting offline is better as there are chances of creating mistakes and taking the wrong plan.

Tip 11:Take a long-term bike insurance plan if possible

Instead of paying a premium for one year, try to take the policy for 3-5 years at a time, as there will be a considerable discount. However, one thing to note here is that you need more flexibility to change the policy. If any issue occurs with the insurance company, your amount will be lost while trying to change the policy. Again, you must be very sure of the insurance company’s performance, the benefits they provide, etc., while selecting.

Tip 12:Become a member of a recognized automobile association or organization

Some motorcycle organizations or clubs offer their members discounts towards vehicle insurance. If you are part of these organizations, such as a touring club or an automobile association, avail of the deal to reduce the bike insurance premium. Please note that only a few insurance companies provide the same.

Tip 13:Opt for Higher bike insurance deductibles

A bike insurance deductible is the portion of a claim the policyholder agrees to pay out-of-pocket expenses while settling claims with the insurance company. It’s like a contribution from the bike owner for the cost of repairs or replacements in case of an accident or damage to your bike.

Choosing a higher deductible can lower your premium, as it reduces the insurer’s risk. However, ensure that the deductible amount is something you can afford to pay out of pocket in the event of a claim.

FAQ about tips to reduce bike insurance premium in India

1. What role does the No Claim Bonus (NCB) play in reducing premiums?

The No Claim Bonus (NCB) is a discount offered by insurers for not making any claims during the policy period. Accumulating NCB over the years can substantially lower your premium costs. It’s essential to ensure that your NCB is transferred if you switch insurers.

2. Is it beneficial to avoid making small claims?

Avoiding small claims helps preserve your No Claim Bonus, which is a critical factor in reducing your bike insurance premiums over time and save money. Holding back on minor claims can lead to significant savings in the long run.

3. How does timely policy renewal affect insurance costs?

Renewing your policy on time ensures continuity in coverage and prevents the spike in premiums that comes with lapses. Timely renewal is crucial for maintaining your No Claim Bonus and avoiding penalties.

4. What is the impact of choosing a higher deductible on premiums?

Opting for a higher deductible can lower your premium, as it reduces the insurer’s risk. However, it’s important to choose a deductible amount that you can afford to pay out of pocket in the event of a claim.

5. How does maintaining a clean driving record affect insurance premiums?

A clean driving record is crucial for reducing insurance premiums. Insurers favor drivers with fewer accidents and violations, as they pose a lower risk. Safe riding practices, such as adhering to traffic rules and avoiding risky maneuvers, can significantly reduce the likelihood of accidents and, consequently, your premiums.

6. Why should I consider installing anti-theft devices on my bike?

Installing anti-theft devices can deter theft and vandalism, reducing the need for insurance claims. Insurers often offer discounts for bikes equipped with security features like alarms, immobilizers, and GPS trackers, as these reduce the risk of theft.

7. Is it beneficial to avoid making small claims?

Avoiding small claims helps preserve your No Claim Bonus, which is a critical factor in reducing your insurance premiums over time. Holding back on minor claims can lead to significant savings in the long run.

8. How does the age of the bike affect the insurance premium?

As a bike gets older, its market value decreases, leading to lower insurance costs. The depreciation of the bike’s value over time results in reduced premiums, making it more affordable to insure older bikes.

9. How can comparing insurance policies help reduce premiums?

Comparing different two-wheeler insurance policies is a fundamental step in finding the best deal. By evaluating various options, you can identify policies that offer the necessary coverage at competitive rates, leading to significant savings.

Other related articles from Bikeleague India

- Two-wheeler insurance in India – How to buy and select

- Understanding bike insurance jargons & Essential Addons

- Must have bike documents for travel in India

- Motorcycle riding style – How to choose your perfect bike

- Second hand motorcycle: Things to know when buying It

Conclusion

I hope you understand all the tips and tricks to reduce your bike insurance premium. If you have any other doubts or queries, email us at bikeleague2017@gmail.com. You can also share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.